oklahoma franchise tax form

Once completed you can sign your fillable form or send for signing. Franchise Tax Payment Options New Business Information New Business Workshop.

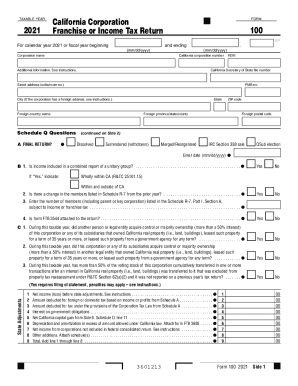

Ca Form 100 Fill Out And Sign Printable Pdf Template Signnow

Ad Fill Sign Email OK Form 200 More Fillable Forms Register and Subscribe Now.

. Get forms by US. Quick steps to complete and eSign Oklahoma Form Franchise Tax online. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now.

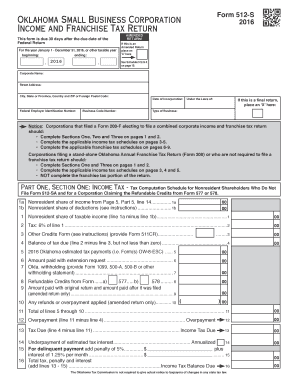

Use Fill to complete blank online STATE OF OKLAHOMA OK pdf forms for free. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or employed in Oklahoma.

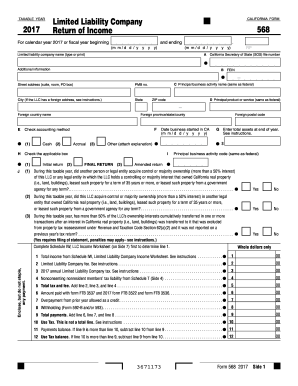

State of Oklahoma Business Filers Income Tax Payment Voucher Instructions 2020 Form EF-V This form is for Business filers completing Form 512 512-S 513 513NR or 514. These elections must be made by July 1. Mail Form 504-C Application for Extension of Time to File an Oklahoma Income Tax Return for Corporations Partner-ships and Fiduciaries with.

Franchise Tax If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. You can download this form from the Oklahoma Tax Commission website wwwtaxokgov. Fill Online Printable Fillable Blank 2021 Form 512-S Oklahoma Small Business Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma Form.

Use Fill to complete blank online STATE OF OKLAHOMA OK pdf forms for free. The Oklahoma franchise tax is mandatory for all for-profit corporations including S-corporations partnerships and limited liability companies organized and maintained in Oklahoma. From Simple to Advanced Income Taxes.

Corporations electing to file a combined income and franchise tax return should use this form when the Total Balance Due is income tax franchise tax or both. Corpora-tions not filing Form 200-F must file a stand-alone Oklaho-ma Annual Franchise Tax Return Form 200. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. How is franchise tax calculated.

The maximum amount of franchise tax that a corporation may pay is 2000000. All organizations falling within the purview of the Franchise Tax Code. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

Once completed you can sign your fillable form or send for signing. To make this election file Form 200-F. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in Oklahoma. Individual filers completing Form 511 or. You can expect a response within 6-8 weeks of filing Form 3911.

Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two. Your Oklahoma return is due 30 days after the due date of your federal return. The franchise tax applies solely to corporations with capital of 201000 or more.

Franchise Tax Computation. Fill Online Printable Fillable Blank 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma Form. Use Get Form or simply click on the template preview to open it in the editor.

Effective November 1 2017 corporations who remit the maximum amount of 2000000 in the preceding tax year the tax will be due and payable on May 1st of each year and delinquent if not paid on or before June 1st. Franchise Tax Computation The basis for computing your Oklahoma Franchise Tax is the balance sheet as shown by your books of account at the close of your last preceding income tax accounting year or if you have elected to change your. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now.

See page 16 for methods of contacting the Oklahoma Tax Commission OTC. Ad We Support All the Common Tax Forms and Most of the Less-Used Forms. 0 Fed 1499 State.

Franchise Tax Board PO Box 942857 Sacramento CA 94257-0631. Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form Form 200-F has been filed. Active Contracts 2021-22 Salary Cap Table Salaries by.

The franchise tax is calculated at the rate of 125 for each 100000 of capital employed in or apportioned to Oklahoma. Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A instructions Revised May 1999. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return.

The new franchise tax rule limits taxpayers annual obligation to a. You may file this form online or download it at taxokgov. Forms - Business Taxes Forms - Income Tax Publications Exemption Letters All Taxes Income - Individual Income - Businesses Motor Vehicles Gross Production Online Registration Reporting Systems Rates Rebates.

If you wish to make an election to change your filing frequency or to file using the Oklahoma Corporate Income Tax Form 512 or 512-S complete OTC Form 200-F. Change Franchise Tax Filing Period. Mine the amount of franchise tax due.

The report and tax will be delinquent if not paid on or before September 15. Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax Form 512-FT-SUP Supplemental Schedule for Form 512-FT Filing date. All forms are printable and downloadable.

Start completing the fillable fields and carefully type in required information. If filing a stand-alone OklahomaAnnual Franchise Tax Return Form 200 do not use this form to remit franchise tax. To make this election file Form 200-F.

To make this election file Form 200-F. Quickly Prepare and File Your 2021 Tax Return. Reinstatement of the franchise tax in 2014 followed a moratorium and enactment of a business activity tax in 2010.

A ten percent 10 penalty and one and one-fourth percent 125 interest per month is due on payments made after the due date. Form 200-F must be filed no later than July 1. File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form.

Only those corporations with capital of 20100000 or more are required to remit the franchise tax. The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200.

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Comics

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Pin By Ca Gulshan Sharma On Legal Services Goods And Service Tax Legal Services Registration

Form 568 2017 Fill Out And Sign Printable Pdf Template Signnow

Fillable Online Form 512 S Fax Email Print Pdffiller

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

14 08 2020 Kota Zila Aaspas Epaper Read Kota Zila Aaspas Local Hindi Newspaper Online Page 1 Politics Kota Are You Ok

Free Grant Of Right To Use 2 Form Printable Real Estate Forms Real Estate Forms Reference Letter Words

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

Top Earning Estates For 2019 Estate Planning Attorney Estate Planning Attorney At Law

Finally A Great Cart Solution Online Business Solutions Business

Pdf Doc Xls Apple Pages Ms Word Free Premium Templates Contract Template Statement Template Agreement

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

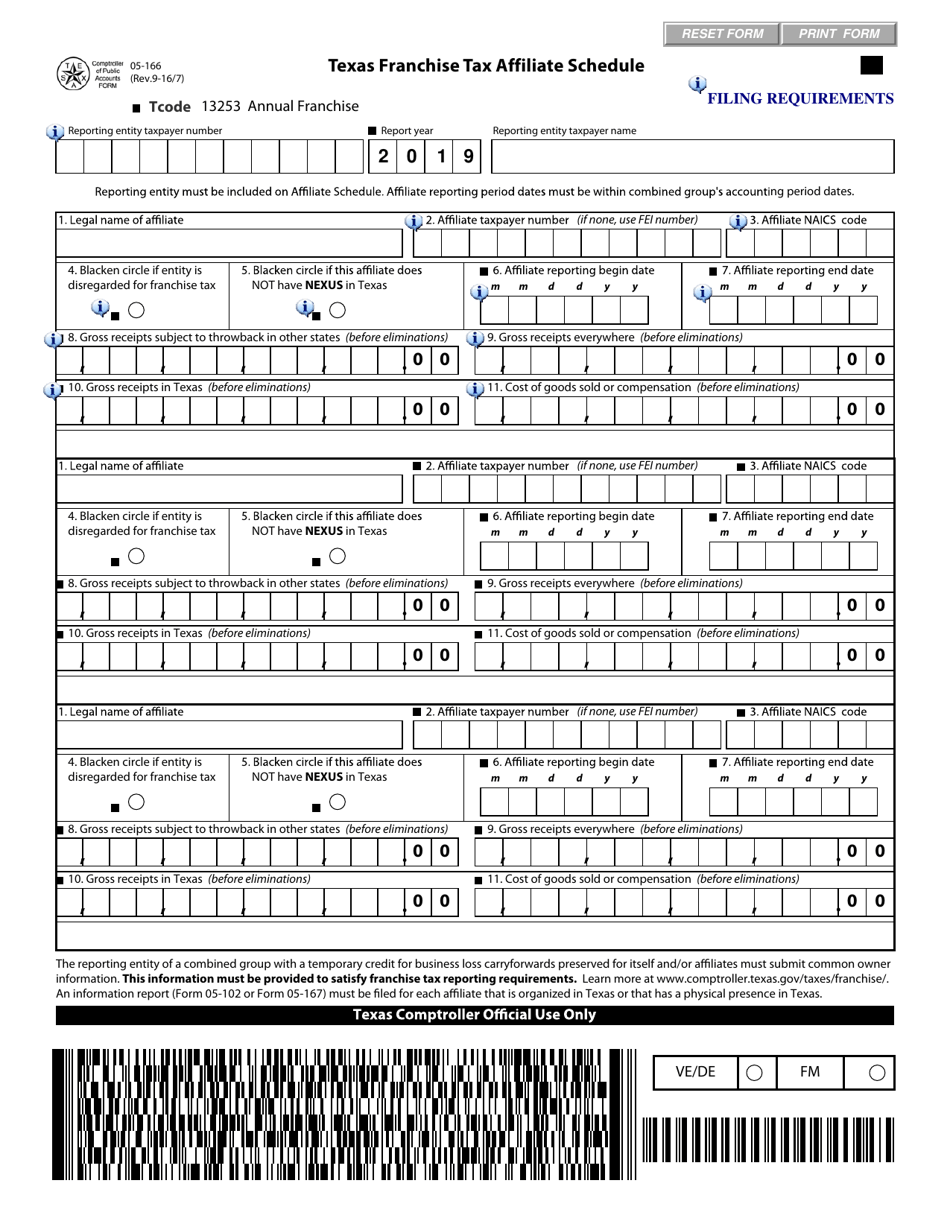

Form 05 166 Download Fillable Pdf Or Fill Online Texas Franchise Tax Affiliate Schedule Texas Templateroller

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

California Tax Forms 2021 Printable State Ca 540 Form And Ca 540 Instructions

Make 275 Per Hour In Free Paypal Money For Reading Make Paypal Money 2022 In 2022 Start Up Business Reading Business Sales

Car Finance Agency Ppv Landing Page Design Car Finance Finance Insurance Money